Anúncios

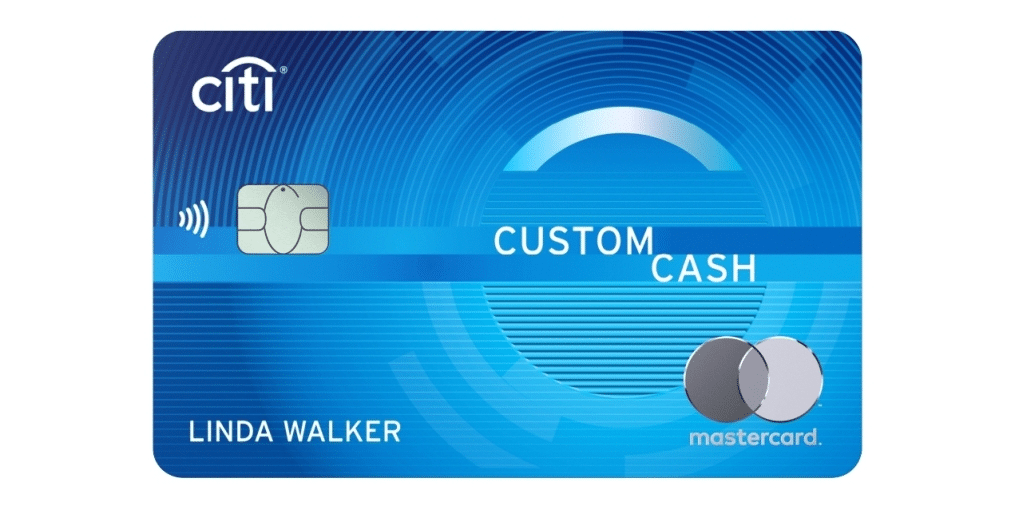

Citi Custom Cash credit card offers convenience, security and financial versatility for users.

Citi Custom Cash

0% introductory APR RewardsThe Citi Custom Cash℠ Card is a uniquely designed cashback card that tailors rewards to your spending habits. With 5% cashback on your highest eligible spending category each billing cycle, this card adapts to your lifestyle, ensuring maximum rewards where you spend the most.

Whether it’s dining, groceries, travel, or another eligible category, the Citi Custom Cash Card eliminates the need to manually choose or activate categories. With no annual fee and seamless integration into Citi’s ecosystem, it’s an ideal option for those who prefer flexibility and personalization in their financial tools.

Rewards That Adjust to You

The standout feature of the Citi Custom Cash℠ Card is its 5% cashback on up to $500 in spending in your top eligible category each billing cycle. Eligible categories include:

- Restaurants

- Grocery stores

- Travel

- Gas stations

- Streaming services

All other purchases earn 1% cashback, ensuring consistent rewards across your spending. This dynamic rewards structure is perfect for individuals with varied spending habits, as the card automatically identifies where you spend the most and adjusts accordingly.

Pros and Cons

Pros

- Automatically earns 5% cashback on your highest eligible category.

- No annual fee.

- $200 welcome bonus for new cardholders.

- 0% introductory APR for 15 months on purchases and balance transfers.

Cons

- 5% cashback capped at $500 per billing cycle.

- Requires good to excellent credit for approval.

Is This the Best Card for You?

The Citi Custom Cash℠ Card is ideal for individuals seeking personalized rewards. Its automatic adjustment to your spending habits ensures that you always earn maximum rewards in your most-used category. However, if you prefer uncapped rewards or elevated benefits in specific categories, other cards may better suit your needs.

Why We Like This Card

The Citi Custom Cash℠ Card combines personalization, flexibility, and affordability. With no annual fee, tailored rewards, and a generous welcome bonus, it’s a versatile option for users looking to maximize their everyday spending.

You will be redirected