Anúncios

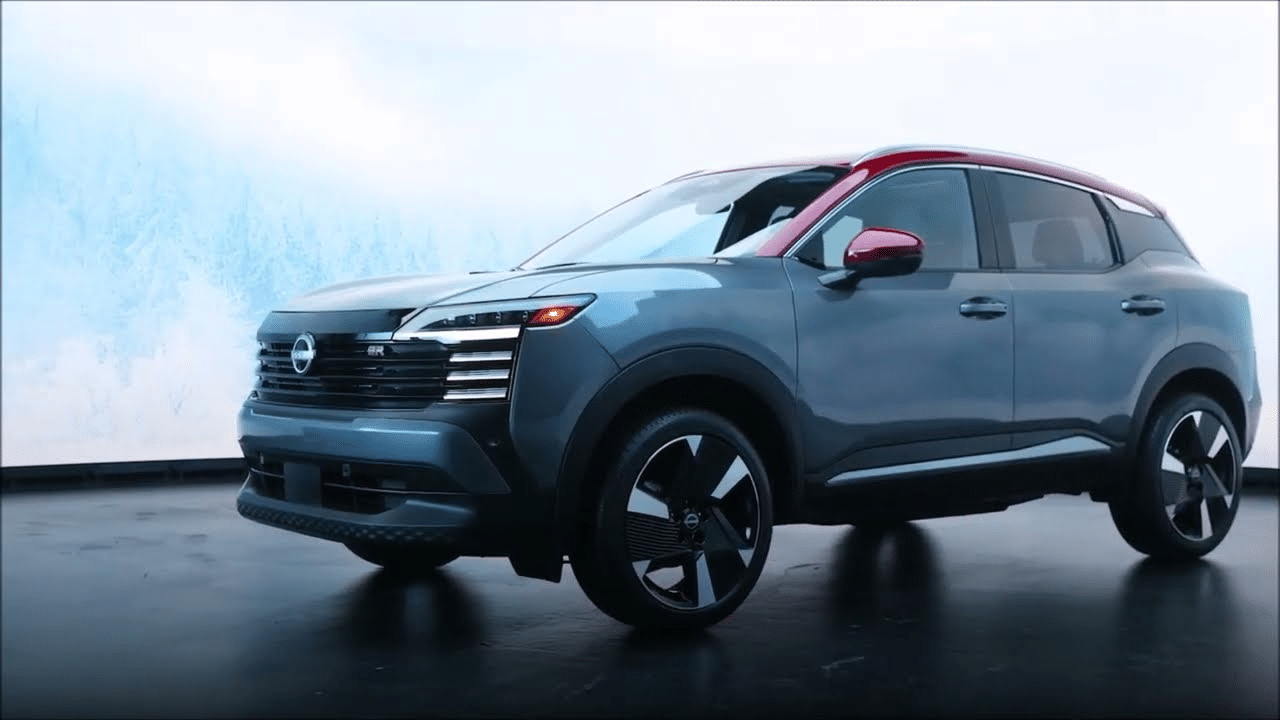

GM Financial is the official lending arm of General Motors, offering auto loans and lease options tailored specifically for Chevrolet, Buick, GMC, and Cadillac buyers.

With manufacturer-backed incentives, flexible terms, and seamless integration at dealerships, GM Financial provides borrowers with a direct way to finance their next vehicle while taking advantage of exclusive brand benefits.

Whether you are buying a new GM vehicle, exploring certified pre-owned options, or refinancing, GM Financial makes the process straightforward and aligned with customer needs.

-

+ Exclusive GM Benefits+

Financing options tied to Chevrolet, Buick, GMC, and Cadillac vehicles.

-

+ Special Offers Available+

Seasonal promotions and loyalty discounts for repeat customers.

-

+ Refinancing and Lease-End Choices+

Lower payments or switch to a new GM vehicle at lease-end.

-

+ Digital Loan Management+

Manage your account, payments, and statements online.

Top Auto Loan Options in the U.S.

GM Financial: Manufacturer-backed financing with promotional incentives and brand loyalty offers.

Toyota Financial Services: Strong incentives for Toyota buyers, especially lease programs.

Ford Credit: Wide range of loan and lease options for Ford and Lincoln customers.

Honda Financial Services: Known for low APR promotions and simple leasing terms.

Capital One Auto Loans: Flexible financing for new, used, and refinancing across brands.

Manufacturer Financing

Best for brand-specific promotions and loyalty deals.

Online Lenders

Provide speed and flexibility, though limited on brand incentives.

Traditional Banks

Provide stable financing, but less brand integration.

Credit Unions

Often offer lower APRs, though membership is required.

Buy Here Pay Here Dealers

Easier approvals, but usually at the cost of much higher interest rates.

How Auto Loans Affect Credit & Finances

GM Financial, like other lenders, reports borrower activity to major credit bureaus. Making on-time payments strengthens your credit profile and can improve your score, opening the door to better borrowing opportunities in the future.

Manufacturer-backed financing also provides opportunities for financial savings through special APRs and loyalty discounts.

By accessing lower rates or cashback, borrowers reduce overall loan costs. However, these promotions may only be available to customers with strong credit scores.

On the other hand, late or missed payments with GM Financial can negatively impact credit and increase financial strain.

Borrowers should also consider the long-term cost of financing versus leasing, as extending repayment terms may lower monthly payments but increase total interest paid.

Ultimately, GM Financial offers more than just financing—it provides brand loyalty advantages and tailored programs that can strengthen financial stability while making it easier to stay in the GM family of vehicles.

You will stay on our website.