Anúncios

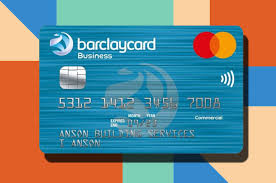

The Barclaycard credit card offers affordability and simple rewards.

The credit card Barclaycard is a versatile and affordable option for those looking for a credit card that combines financial benefits with a simple rewards structure.

With a variety of rewards programs and additional benefits, this card is perfect for consumers looking to get maximum value from their everyday purchases.

This card gives you access to a points program that you can use to travel, make purchases and even reduce your bills.In addition, it also has advanced digital spending management tools that provide users with superior financial management.

The competitive fee structure and wide acceptance of the Barclaycard credit card make it stand out as a reliable and convenient choice for consumers with diverse financial profiles.

Barclaycard Credit Card

Customizable options Modern tools:How does the Barclaycard Credit Card credit card work?

The Barclaycard credit card works through an integrated rewards system, allowing you to earn points or cashback on every purchase.Points can be redeemed in various categories, including travel, consumer goods and discounts on fares.

Cardholders also have access to a digital dashboard where they can monitor transactions, set spending alerts and manage payments easily.The card is accepted in many national and international establishments, making it convenient to use anywhere.

In addition, the card offers an introductory period with a reduced APR on purchases and balance transfers, making it an attractive option for those wishing to consolidate debts or plan larger purchases at lower costs.

Main benefits of Barclaycard Credit Card

The Barclaycard credit card offers an excellent rewards structure that allows users to earn points or cashback on every purchase, regardless of the category.

Safety and Security: Barclaycard credit card users receive a robust set of security measures, including: Real-time alerts on suspicious transactions, fraud prevention and access to credit monitoring services.

Financial management tools: The Barclaycard credit card offers a variety of useful tools to help cardholders manage their personal finances effectively.

Access to Promotions and Discounts: This card also gives users access to regular promotions that give them discounts on various categories of purchases.From clothing to technology, Barclaycard holders can take advantage of these offers to save on essential products.

You will be redirected

Cons of Barclaycard Credit Card

Applicable fees: The Barclays credit card is competitive in terms of advantages and benefits, but there are fees that can have a negative impact on those who do not pay their balance in full on time.

Interest rates can be relatively high, especially on unpaid amounts, and careless use of the card can reduce the value of accrued benefits.

- Conditional Benefits: The Barclaycard Credit Card offers a number of benefits, some of which are subject to specific conditions.For example, cashback offers or extra points may only be available for certain periods or for certain purchase categories.

- APR after the introductory period: Barclaycard credit cards may offer a low introductory interest rate or even zero interest during the introductory period.

However, interest rates can increase significantly after this period, which can be detrimental to those who are unable to pay off the balance in full by the end of the promotional period.

Limiting points on certain purchases: As part of the reward earning conditions, your Barclaycard credit card may limit the number of points or cashback you can earn on certain purchases.

Limitations on rewards in some categories: Barclaycard offers rewards on all purchases, but some spending categories may not provide the same returns as others. This means that users should focus their purchases on specific categories to maximize their benefits.

Limitations on rewards in some categories: Barclaycard offers rewards on all purchases, but some spending categories may not provide the same returns as others. This means that users should focus their purchases on specific categories to maximize their benefits.

APR and fees

The credit card Barclaycard credit card offers a competitive introductory APR on purchases and balance transfers, making it ideal for those who want to save money in the short term.

After this period, the interest rate will change depending on the cardholder’s credit situation.There are plans with no annual fee, but it’s important to check the specific conditions when signing up.

Other fees include cash withdrawal fees and late payment fees.We recommend that you read the full Terms and Conditions to understand all the terms and conditions that apply to the use of the Card.

How to apply for Barclaycard Credit Card?

Applying for a credit card Barclays credit card is easy and can be done online. Simply visit the official Barclays Card website and complete the application form by entering information such as income, financial history and personal information.

A credit analysis determines the applicant’s eligibility. Once approved, the card will be sent to the registered address and the cardholder will be able to activate the card and start using it immediately.

To increase your chances of being approved, maintain a good credit history and make sure that all the information you provide is accurate and current.Once activated, you will be able to collect rewards and take advantage of all the benefits available.