Anúncios

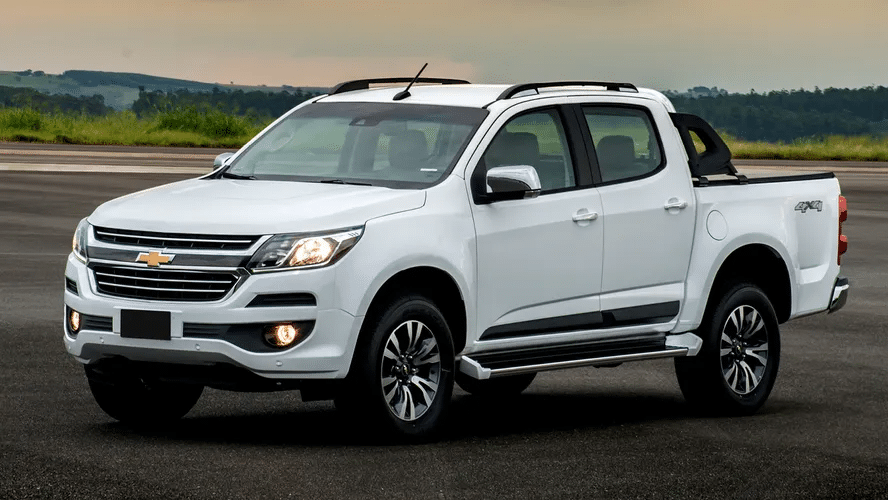

Financing a Chevrolet vehicle doesn’t have to be complicated.

With Chevrolet Auto Financing, drivers gain access to tailored loan and lease options backed by a trusted manufacturer.

Whether you’re shopping for a brand-new Silverado, a family-friendly Equinox, or a pre-owned Cruze, Chevrolet makes it easier to get behind the wheel with financing programs designed for flexibility and affordability.

By combining manufacturer-backed promotions, competitive interest rates, and dealer support nationwide, Chevrolet Auto Financing provides a clear path for buyers looking for both convenience and peace of mind.

-

+ Manufacturer-Backed Offers+

Chevrolet provides loyalty discounts, cashback deals, and promotional APRs.

-

+ Options for All Buyers+

Choose between leasing, financing new vehicles, or certified pre-owned options.

-

+ Integrated Dealership Support+

Finalize your financing at the same place you purchase your Chevy.

-

+ Digital Tools+

Use Chevrolet’s online portal to explore offers, estimate payments, and apply.

Top Auto Loan Options in the U.S.

Chevrolet Auto Financing: Strong manufacturer support and promotional APRs for loyal buyers.

Bank of America Auto Loans: Known for competitive refinancing and digital tools.

Chase Auto Loans: Offers relationship discounts and an extensive dealer network.

Capital One Auto Loans: Prequalification and car-shopping tools in one platform.

Credit Union Loans: Often the lowest APRs, though limited to members.

Traditional Banks

Provide security and fixed rates but fewer promotional perks.

Credit Unions

Ideal for buyers seeking loyalty discounts and brand-specific offers.

Online Lenders

Quick comparisons, though not tied to vehicle promotions.

Manufacturer Financing

Flexibility but higher APRs.

Buy Here Pay Here Dealers

Accessible for bad credit, but much higher long-term costs.

How Auto Loans Affect Credit & Finances

Chevrolet Auto Financing can help borrowers strengthen their financial profile when used wisely.

Making consistent, on-time payments builds positive credit history and gradually raises your credit score, which can unlock better rates on future loans.

For many buyers, this financing isn’t just about driving a new Chevy—it’s also a step toward healthier credit.

Manufacturer financing also gives borrowers access to promotional APRs or cashback incentives, which can lower the cost of ownership.

However, buyers should carefully evaluate lease versus loan options, since leasing may mean lower payments now but no equity in the vehicle at the end of the term.

Credit inquiries also play a role. Prequalification tools may use a soft inquiry, while final applications require a hard credit check. Fortunately, when multiple auto loan inquiries are made within a short period, they are usually treated as one, minimizing credit impact.it bureaus builds credit history, gradually improving your score.

Strong credit not only helps with future auto loans but can also lower borrowing costs across mortgages, credit cards, and personal loans.

Borrowers also benefit from Bank of America’s refinancing program, which can improve monthly cash flow by lowering interest rates or extending loan terms.

However, while longer repayment periods reduce short-term strain, they often increase the total cost of the loan, so balancing affordability with long-term savings is critical.

Another important factor is credit inquiries. Prequalification with Bank of America uses a soft inquiry, so you can shop without harming your score.

Once you move forward with an application, a hard inquiry is required, but credit scoring systems typically treat multiple auto loan inquiries within a short timeframe as one.

This minimizes the impact while allowing borrowers to compare lenders.

You will stay on our website.