Anúncios

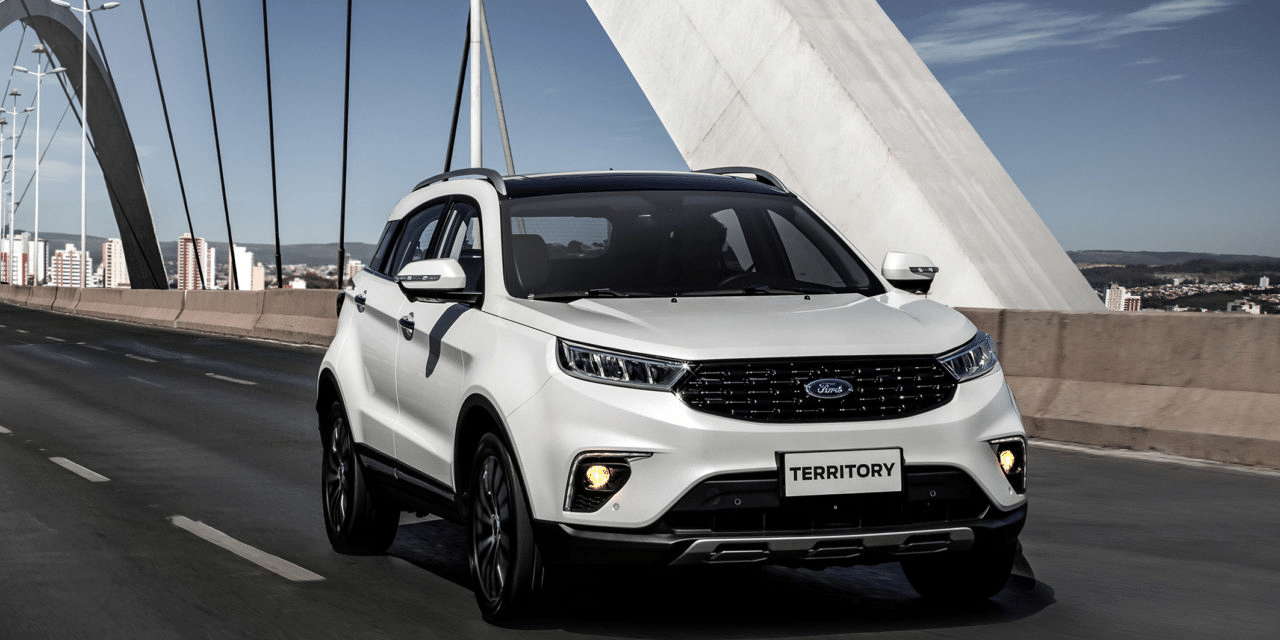

Owning a Ford has long been part of the American driving experience.

Whether it’s the power of an F-150, the practicality of an Escape, or the innovation of the Mustang Mach-E, financing a Ford vehicle can make dreams a reality without the burden of paying everything upfront.

Ford offers multiple paths for financing through its dedicated financial arm, Ford Credit, as well as partnerships with dealers and lenders nationwide.

With competitive APRs, flexible terms, and special promotions designed for both loyal Ford drivers and first-time buyers, financing a Ford in the U.S. is designed to balance affordability with convenience.

-

+ Special Ford Offers+

Enjoy promotional APRs, loyalty programs, and cashback on select vehicles.

-

+ Flexible Terms+

Choose from shorter or longer repayment schedules to fit your budget.

-

+ Certified Pre-Owned Financing+

Drive with confidence through Ford’s warranty-backed CPO options.

-

+ Dealer Integration+

Secure financing and purchase your Ford at the same location.

Top Auto Loan Options in the U.S.

Ford Credit Financing: Manufacturer-specific deals, loyalty offers, and integration with dealerships.

Chase Auto Loans: Wide dealer network and discounts for existing customers.

Bank of America Auto Loans: Known for strong refinancing options and competitive APRs.

Capital One Auto Loans: Digital-first approach with its Auto Navigator tool.

Consumers Credit Union Auto Loans: Lower APRs through membership benefits.

Credit Unions

Excellent for low APRs, but membership is required.

Traditional Banks

Reliable lending but fewer promotional offers.

Online Lenders

Fast approvals and flexibility, but limited manufacturer deals.

Buy Here Pay Here Dealers

Easy approvals, but much higher long-term costs.

Manufacturer Financing

Best for special promotions and loyalty perks.

How Auto Loans Affect Credit & Finances

Financing a Ford vehicle has clear implications for both credit and long-term financial health.

On the positive side, consistent, on-time payments build strong credit history, which can improve your score and make future loans—like mortgages or personal loans—more affordable.

Ford Credit and partner lenders report regularly to the credit bureaus, ensuring your responsible habits are recorded.

Promotional financing programs can also make vehicles more affordable, but borrowers should weigh short-term benefits against the total cost of the loan.

For example, extending a loan term lowers monthly payments but increases the amount of interest paid overall.

Prequalification tools, often available through Ford Credit, allow borrowers to explore terms without affecting their credit score. This minimizes risk while shopping and helps set realistic budgets before heading to the dealership.

Once a formal application is submitted, a hard inquiry occurs, but credit scoring models typically count multiple inquiries within a short time frame as one, helping protect your credit.

You will stay on our website.